How to Search Loan Records the Easy Way

Many county offices charge per-page fees and require in-person visits to access public records. Skip the hassle with PropertyChecker, where you can search nationwide home loan records instantly, saving time and money.

- No More Manual Searches – Find everything in one place.

- Nationwide Coverage – Access records across the U.S. in seconds.

- Fast & Reliable Data – Verified from thousands of public and private sources.

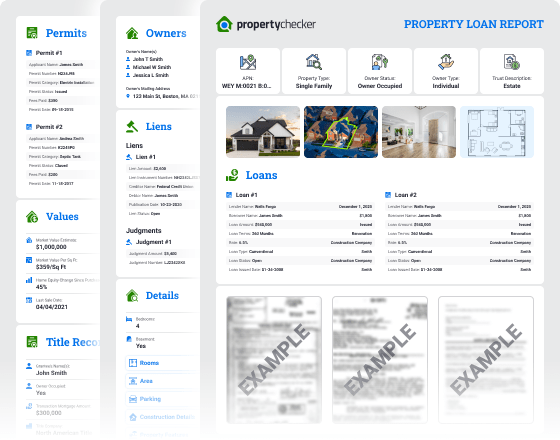

Some of the loan details you can find with PropertyChecker include:

- Mortgage Amount & Date

- Lender Name & Type

- Loan Type & Lender Code

- Loan Transfers & Refinancing Record

- Ownership & Lien History

- Foreclosures & Tax Data

- And Much More!

Power of Property Data Under Your Fingertips

Loan Records

- Property Deeds

- Property Liens

- Foreclosures

- Much More!

Purchase History

- Sales History

- Past Sale Prices

- Sale Dates

- Transfer Types

- Much More!

Owner Information

- Names

- Addresses

- Phone Numbers

- Emails

- Much More!

Property Values

- Sales History

- Market Value

- Equity

- Much More!

Mortgage Records

- Lenders

- Mortgage Amount

- Second Mortgage

- Much More!

Property Taxes

- Tax Bill Amount

- Assessed Value

- Tax Delinquency

- Much More!

Property Details

- Property Features

- Building Permits

- Parcel Info

- Much More!

Building Permits

- Dates

- Permit Types

- Business Type

- Fees, Status

- Much More!

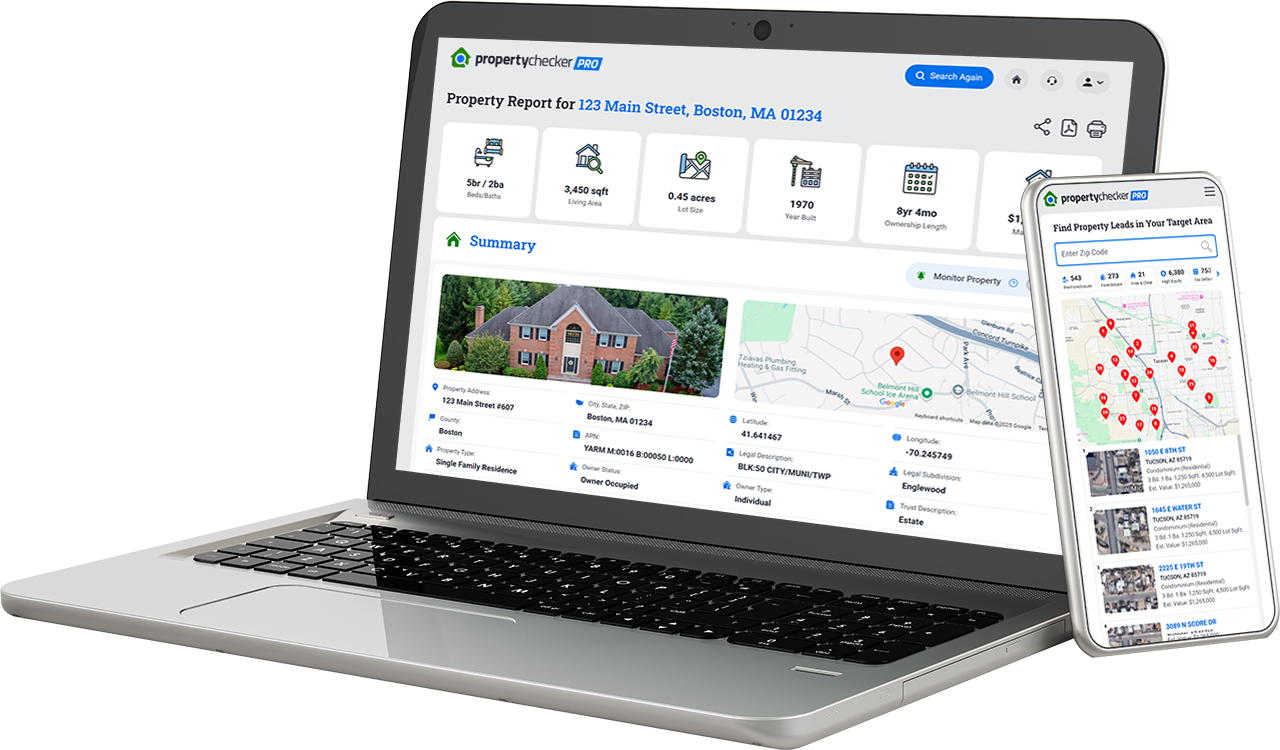

PropertyChecker is the most affordable and efficient way to find local and nationwide property records.

Our database covers over 158 million properties in over 3,000 counties and is updated daily.

Why Search for Home Loan Records?

Various professionals search through loan records for many different reasons. Since loan records are public records, anyone can access them without cause. Some of the more popular reasons a person searches for loan records include:

- Gain a Competitive Edge – Identify distressed properties and off-market deals before they hit the market.

- Find Motivated Sellers – Uncover high-debt homeowners who may be willing to sell below market value.

- Assess Property Value – Compare loan balances, assessed values, and market trends for smarter investment decisions.

- Targeted Marketing Opportunities – Use loan data to identify potential leads for refinancing, home equity loans, or real estate offers.

- Verify Home Ownership – Ensure a property’s true owner and any outstanding liens before making a move.

What is a Home Loan Search?

A home loan search is the process of looking for public home loans and mortgages that are readily available. You can find these records by entering the property address or owner’s name into unique search engines like PropertyChecker and reviewing the results. These searches show current records and historical records going all the way back to the first home loan on the property.

Regardless of why you need to research someone’s mortgage records, the trick is knowing how to find them quickly. You can use county, municipal, and state sources by visiting government offices and asking for copies. However, since these records may be stored in dozens of locations and you must pay a per-page fee, running around looking for the complete story can be costly and time-consuming.

How Mortgage Loans Work

Mortgages are long-term loans secured by real estate, commonly structured as 15- or 30-year loans with fixed or adjustable rates. Before approving a mortgage, the lender will assess:

- Home Value & Appraisal

- Credit Score & Debt-to-Income Ratio

- Type of Home and Condition

- Loan Type (FHA, VA, Conventional, Jumbo, etc.)

A refinance allows homeowners to lower interest rates, access home equity, or change loan terms—all of which appear in loan records.

The Difference Between a Mortgage and a Home Loan

Some people use the terms mortgage and home loans interchangeably, but they differ slightly. A mortgage is a broad term referring to any loan secured by real estate. A home loan is a type of mortgage used to purchase property and secured by real estate as collateral. Mortgages can be used to refinance, buy a home, or even supply cash for the equity in the home. All home loans are mortgages, but not all mortgages are home loans.

Does Refinancing Show Up on Loan Records?

People refinance homes for many reasons. Often, it is to improve the interest rate. If a couple buys a house when rates are high, later, they can refinance at a lower rate and make their mortgage payment more affordable. Sometimes, homeowners refinance to take advantage of the equity in their home and use it to make improvements or pay for a significant expense like the kids’ college. Refinance mortgages do show up in loan records. You may also see the payoff of the old mortgage as the new one replaces it.

Try PropertyChecker Today!

Try PropertyChecker for FREE. Get instant access to home loan records right now. Simply enter an address or owner’s name below and start searching for mortgage details, ownership records, and more, all in seconds!

Give it a try today and see how much we have to offer.

Access Every Feature You Need to Find, Analyze, and Invest in Properties

Find Investment Properties with 15+ Targeted Lead Lists

Gain access to 160+ million properties nationwide, backed by 248+ million mortgage and loan records and 300+ million building permits — all in one powerful platform.

Foreclosures

Pre-Foreclosures

Free & Clear

High Equity

Tax Default

Vacant Lots

Intra-Family Transfers

Out-of-State Owners

Not-a-Principal Residence

Recently Sold

Flipped Properties

Failed Listings

State Property Records

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Foreclosures

Foreclosures Pre-Foreclosures

Pre-Foreclosures Free & Clear

Free & Clear High Equity

High Equity Tax Default

Tax Default Vacant Lots

Vacant Lots Intra-Family Transfers

Intra-Family Transfers Out-of-State Owners

Out-of-State Owners Not-a-Principal Residence

Not-a-Principal Residence Recently Sold

Recently Sold Flipped Properties

Flipped Properties Failed Listings

Failed Listings