How to Perform Your Own Title Search

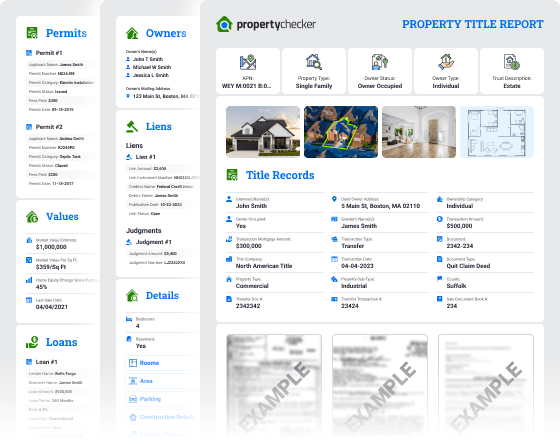

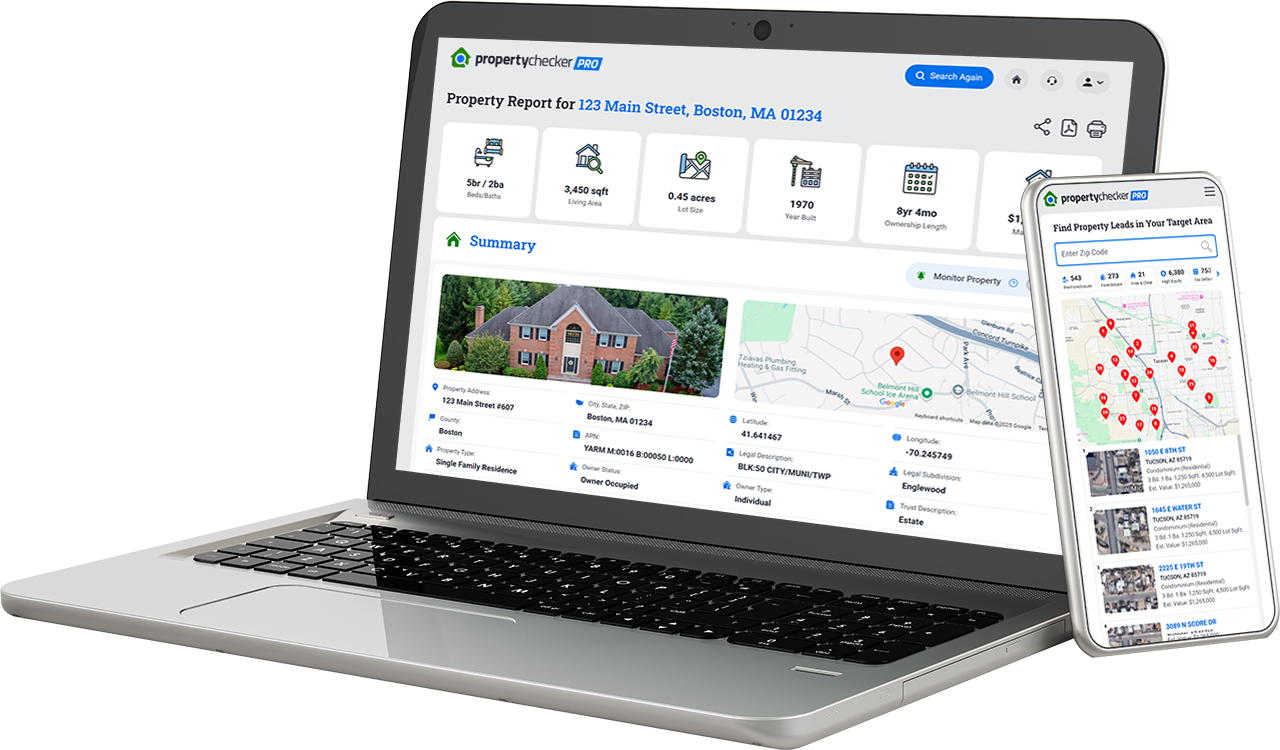

You can tap into millions of property records using PropertyChecker. Traditionally, title searches required visiting multiple county, city, and state offices, paying fees, and manually pulling records. PropertyChecker eliminates the hassle by consolidating everything into one easy-to-use platform.

Instead of visiting dozens of government offices and paying for paper copies, you can log onto PropertyChecker and see a detailed report within seconds. PropertyChecker gathers data from state, city, and county offices and public and private sources to consolidate all the information into one easy-to-use, affordable tool.

Some of the information you will find on PropertyChecker includes:

- Complete Ownership History

- Purchase History

- Loans/Mortgages

- Deeds

- Property Tax Records

- Property Values (assessments & appraisals)

- Building Permits

- Foreclosures

- Liens

- Neighborhood Information (nearby schools, parks, crime stats, etc.)

- Property Details (sq. footage, # of beds/baths, renovations, etc.)

- And Much More!

Power of Property Data Under Your Fingertips

Title/Deed Records

- Property Deeds

- Property Liens

- Foreclosures

- Much More!

Purchase History

- Sales History

- Past Sale Prices

- Sale Dates

- Transfer Types

- Much More!

Owner Information

- Names

- Addresses

- Phone Numbers

- Emails

- Much More!

Property Values

- Sales History

- Market Value

- Equity

- Much More!

Mortgage Records

- Lenders

- Mortgage Amount

- Second Mortgage

- Much More!

Property Taxes

- Tax Bill Amount

- Assessed Value

- Tax Delinquency

- Much More!

Property Details

- Property Features

- Building Permits

- Parcel Info

- Much More!

Building Permits

- Dates

- Permit Types

- Business Type

- Fees, Status

- Much More!

PropertyChecker is the most affordable and

efficient way to find local and nationwide property records.

Our database covers over 158

million properties in over 3,000

counties and is updated daily.

What is a Title Search?

A title search consists of using public property records and legal documents to research a particular property’s title and evaluate its ownership history. Title searches are most useful when buying or selling real estate, resolving ownership disputes, and before refinancing. You can find ownership information, liens, foreclosures, mortgages, title disputes, and other encumbrances during the process. The issue is that these records are scattered among a few different government offices, making it cumbersome to pull a complete report unless you use a system like PropertyChecker.

Reasons for a Title Search

Title companies, real estate attorneys, and abstractors (researchers) perform title searches for various reasons. The most common is before the sale or transfer of property. Some of the reasons that a title search is essential include:

- Confirm Legal Ownership – Ensure the seller has the legal right to transfer the property.

- Uncover Liens & Debts – Detect unpaid mortgages, tax liens, or judgments that could impact your purchase.

- Check for Easements & Restrictions – Avoid surprises about land use limitations or rights-of-way before you buy.

- Prevent Costly Legal Issues – A thorough search helps protect against ownership disputes and fraudulent transfers.

- Streamline Property Research – Whether you’re buying, selling, or refinancing, a title search provides critical insights upfront.

Benefits of Using PropertyChecker

- Nationwide Coverage – Search millions of property records instantly.

- Fast & Accurate Reports – Get results in seconds instead of days.

- Affordable & Convenient – Save time and money with one streamlined tool.

The Difference Between a Deed and a Home Title

A deed is a legal document that transfers property between a buyer and seller. It details the property, its location, the buyer and seller, conveyance details, and any easements or restrictions. Title is an abstract concept about the legal right to own, use, and dispose of a property. The title is established through the deed and previous ownership documents (chain of title). It is not a physical document but rather an understanding of who actually owns the property.

A title search helps ensure a clear chain of ownership so there are no legal disputes or hidden claims affecting your property.

How the Title Search Process Works

Anyone performing a title search will research and examine public property records to piece together the entire chain of title, showing who owned the property at various times and how and when it transferred to another. The professional will create a chronology of all the legal documents showing the ownership history. They may also examine property surveys, easements, and any wills or lawsuits related to the property.

Every state handles property records differently, so you need to know where to look for the correct information on a property. That can be challenging since the records may be with the county, city, or state repository. There is no “one” office where you can show up and find everything. You must visit a few different places to get the complete picture.

The process may uncover unpaid taxes, ownership issues, lawsuits, liens, foreclosures, or other problems that could create trouble during the sale or transfer of property. If anything is found, it must be resolved before the sale can close. The ideal situation is to discover a “clean title” free of any defects or issues.

During the home-buying/selling process, the buyer can purchase title insurance. This protects their lender and themselves if, after the sale, an issue arises showing that the seller was not the legal owner. Title insurance is typically very affordable and worth it to prevent future legal matters. Homebuyers who take out a mortgage are required to purchase title insurance. The lender must protect themselves against any legal claims on the property.

Try PropertyChecker Today!

Ready to unlock property details in seconds? Search by owner’s name, property address, email, phone number, or parcel ID, and get instant access to property title records today! Save time and money using PropertyChecker. Try PropertyChecker for FREE to perform your own property title search today.

Start by running a free scan in the search box below.

Access Every Feature You Need to Find, Analyze, and Invest in Properties

Find Investment Properties with 15+ Targeted Lead Lists

Gain access to 160+ million properties nationwide, backed by 248+ million mortgage and loan records and 300+ million building permits — all in one powerful platform.

Foreclosures

Pre-Foreclosures

Free & Clear

High Equity

Tax Default

Vacant Lots

Intra-Family Transfers

Out-of-State Owners

Not-a-Principal Residence

Recently Sold

Flipped Properties

Failed Listings

State Property Records

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Foreclosures

Foreclosures Pre-Foreclosures

Pre-Foreclosures Free & Clear

Free & Clear High Equity

High Equity Tax Default

Tax Default Vacant Lots

Vacant Lots Intra-Family Transfers

Intra-Family Transfers Out-of-State Owners

Out-of-State Owners Not-a-Principal Residence

Not-a-Principal Residence Recently Sold

Recently Sold Flipped Properties

Flipped Properties Failed Listings

Failed Listings