How PropertyChecker’s Home Title Monitoring Protects You

Home title monitoring can help protect against any of the scenarios above. Some of the ways home title protection safeguards you are:

- 24/7 Property Monitoring – We continuously scan public records for changes to your home’s title.

- Instant Alerts – Get notified immediately if someone attempts to alter your deed.

- Loan & Mortgage Monitoring – Stay ahead of potential fraudulent loans tied to your property.

- Prevents Unauthorized Transactions – Home title monitoring can detect if someone is trying to sell or mortgage your home without your knowledge.

- Peace of Mind – Sleep easy, knowing your most valuable asset is protected.

Unlike title insurance, which only covers past issues, PropertyChecker actively defends against new fraud attempts—helping you stop scammers before they succeed.

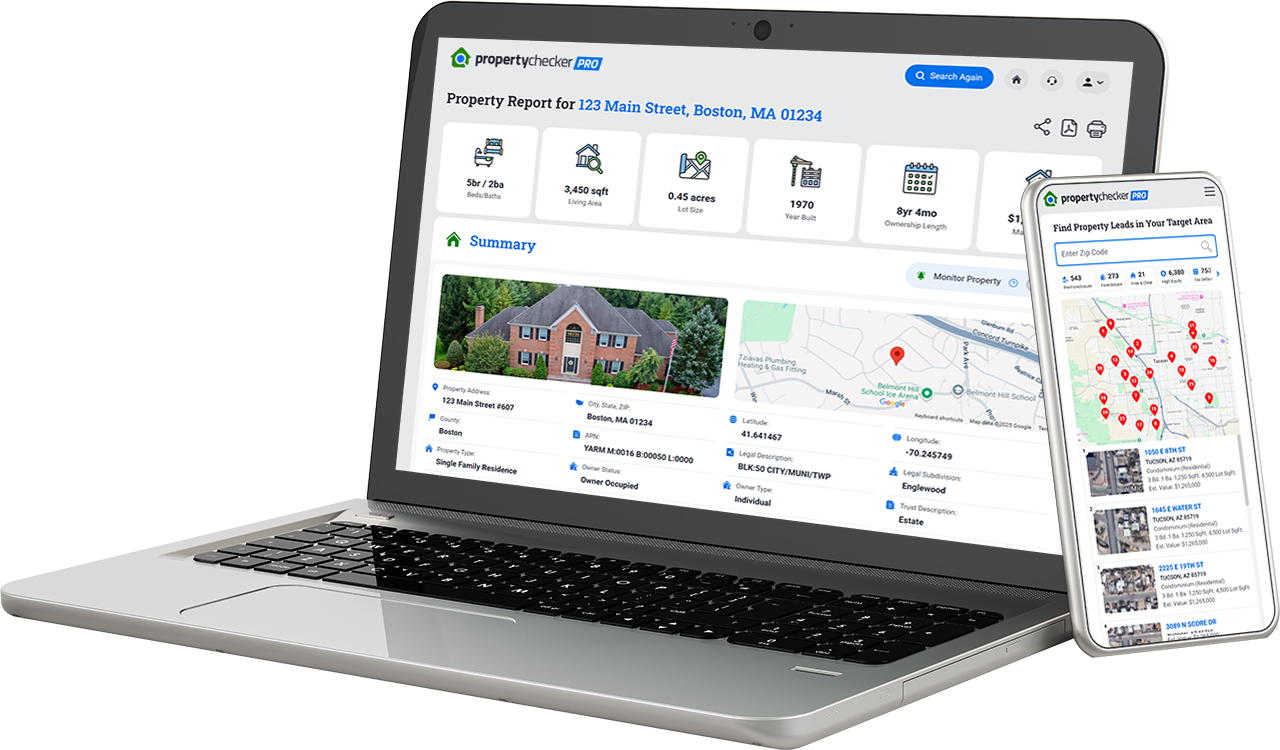

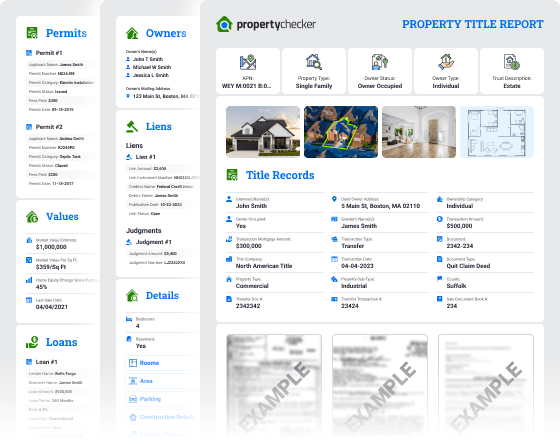

Power of Property Data Under Your Fingertips

Title/Deed Records

- Property Deeds

- Property Liens

- Foreclosures

- Much More!

Purchase History

- Sales History

- Past Sale Prices

- Sale Dates

- Transfer Types

- Much More!

Owner Information

- Names

- Addresses

- Phone Numbers

- Emails

- Much More!

Property Values

- Sales History

- Market Value

- Equity

- Much More!

Mortgage Records

- Lenders

- Mortgage Amount

- Second Mortgage

- Much More!

Property Taxes

- Tax Bill Amount

- Assessed Value

- Tax Delinquency

- Much More!

Property Details

- Property Features

- Building Permits

- Parcel Info

- Much More!

Building Permits

- Dates

- Permit Types

- Business Type

- Fees, Status

- Much More!

PropertyChecker is the most affordable and efficient way to find local and nationwide property records.

Our database covers over 158 million properties in over 3,000 counties and is updated daily.

Protect Your Home with PropertyChecker’s Home Title Monitoring

Imagine waking up one day to find out that someone has fraudulently transferred your home’s title, taken out loans in your name, or even sold your property without your knowledge. Home title fraud is a growing threat, and cybercriminals are finding new ways to exploit homeowners every day.

PropertyChecker’s Home Title Monitoring provides continuous monitoring and instant alerts, helping you safeguard your home before it’s too late.

What is Home Title Monitoring?

Home title monitoring is a proactive service that keeps an eye on your property’s records. Unlike title insurance, which only protects against past title issues, our service monitors public records and alerts you if any unauthorized changes are made to your deed or title. For example, if a long-lost cousin to the seller shows up on your doorstep and says they are the rightful owner, that is when title insurance protects you. Home title monitoring is a proactive service that monitors public records for any unauthorized or suspicious activity related to your home ownership records.

With PropertyChecker’s Home Title Monitoring, you get real-time notifications of suspicious activity, allowing you to take immediate action and protect your investment.

How Home Title Fraud Happens

Home title scams are a form of identity theft where fraudsters forge documents or trick homeowners into signing over their deeds. Once the fraudulent deed is filed with the county, the scammer can:

- Sell Your Home Without Your Knowledge

- Take Out Home Equity Loans in Your Name

- Refinance and Drain Your Property’s Value

Some fraudsters contact homeowners in financial trouble and offer to refinance quickly and easily. While going through the motions of a refi, the scammer will ask the homeowner to sign the deed over, thus giving up control of their home in return for a quick, no-questions-asked loan. The poor, unsuspecting homeowner never sees any money and now has lost their home.

Some scammers use a fraudulent deed to open up a home equity line of credit (HELOC) and amass a mountain of debt they will never pay off. Unfortunately, the homeowner is responsible for that debt unless they can prove otherwise.

Some signs of home title theft include:

- Unusual or suspicious activity on your credit file.

- Missing utility bills or tax statements.

- Mail regarding new accounts you didn’t open.

- Alerts about identity theft linked to your property.

Does Home Title Monitoring Prevent Fraud?

While no service can prevent fraud entirely, PropertyChecker’s Home Title Monitoring ensures you’re the first to know about suspicious activity. The sooner you’re alerted, the faster you can take action to protect your home.

How to Protect Your Home Title

Do all you can to protect your home title. Thankfully, with home title monitoring, you have a watchdog scanning records ready to alert you at the first sign of danger. Some ways you can keep your home protected are:

- Regularly Check Your Property Records - Monitor changes through your county recorder’s office or use PropertyChecker for automated updates.

- Freeze Your Property Title (If Possible) - Some counties allow you to freeze your title so that no changes are made to your deed without your express permission.

- Buy Title Insurance - Keep title insurance on your property to avoid any financial losses that could ensue if any past title issues arise.

- Be Careful with Your Personal Information - Avoid sharing sensitive details with unknown parties (offline or online).

- Sign Up for Title Monitoring with PropertyChecker - Let us monitor your title and alert you to any suspicious changes.

What to Do if Your Home Ownership Information Has Been Changed

It is alarming to find out that a total stranger changed your home title information. Don’t panic. Remain calm and find out who changed it. If a title company or attorney was involved, contact them and inform them of the fraud. Also, contact your local county recorder’s office (or similar government agency) and the tax assessor’s office and report the fraudulent change to your deed. Alert your title insurance company; they may be able to help reverse fraudulent transactions. You may have to work with county officials to fix the problem; as a last resort, you may need to hire an attorney.

Access Every Feature You Need to Find, Analyze, and Invest in Properties

Find Investment Properties with 15+ Targeted Lead Lists

Gain access to 160+ million properties nationwide, backed by 248+ million mortgage and loan records and 300+ million building permits — all in one powerful platform.

Foreclosures

Pre-Foreclosures

Free & Clear

High Equity

Tax Default

Vacant Lots

Intra-Family Transfers

Out-of-State Owners

Not-a-Principal Residence

Recently Sold

Flipped Properties

Failed Listings

State Property Records

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Foreclosures

Foreclosures Pre-Foreclosures

Pre-Foreclosures Free & Clear

Free & Clear High Equity

High Equity Tax Default

Tax Default Vacant Lots

Vacant Lots Intra-Family Transfers

Intra-Family Transfers Out-of-State Owners

Out-of-State Owners Not-a-Principal Residence

Not-a-Principal Residence Recently Sold

Recently Sold Flipped Properties

Flipped Properties Failed Listings

Failed Listings