How Many Homes Are Abandoned in the U.S., Why It Happens, and What It Causes

Table of Contents

- How Many Homes Are Abandoned in the U.S., Why It Happens, and What It Causes

- Why do houses become abandoned?

- Foreclosures

- Urban Decline

- Government Policy Failures

- Disasters & Climate Risks

- Zoning & Development Restrictions

- The Hidden Cost of Abandonment

- Crime & Safety

- Economic Decline

- Mental Health Toll

- Housing Affordability Crisis

- Why aren’t new homes taking up the baton?

- What can be done?

- Make the most of that hidden housing resource

Across the U.S., millions of homes sit empty—not just vacant, but forgotten, decaying, and slipping further from the public eye. Entire neighborhoods bear the scars of economic shifts, industrial decline, and policy gaps, leaving behind streets of lifeless properties. But what if these "lost homes" could be repurposed to breathe life back into communities?

Detroit's experience with abandoned homes has become a symbol of this nationwide issue. But while the city's struggles have garnered attention, similar stories are playing out in countless communities, both rural and urban, across the United States.

The Scale of the Problem

In 2023, the Census Bureau found over 15.2 million homes without occupants, a number that peaked at 19 million in 2008, following one of the worst housing crises in recent memory.

The current occupancy rate in America, at 65.1%, is close to historical norms. The national vacancy rate, at 10.5%, is the lowest since the Census Bureau began recording. The national numbers seem to have remained at the mean for several years.

According to statistics from Attomdata, nearly 2,500 foreclosed properties are abandoned each month in the U.S. That's 7,109 in the fourth quarter of 2024 alone. Yet, this figure is only a fraction of the reality.

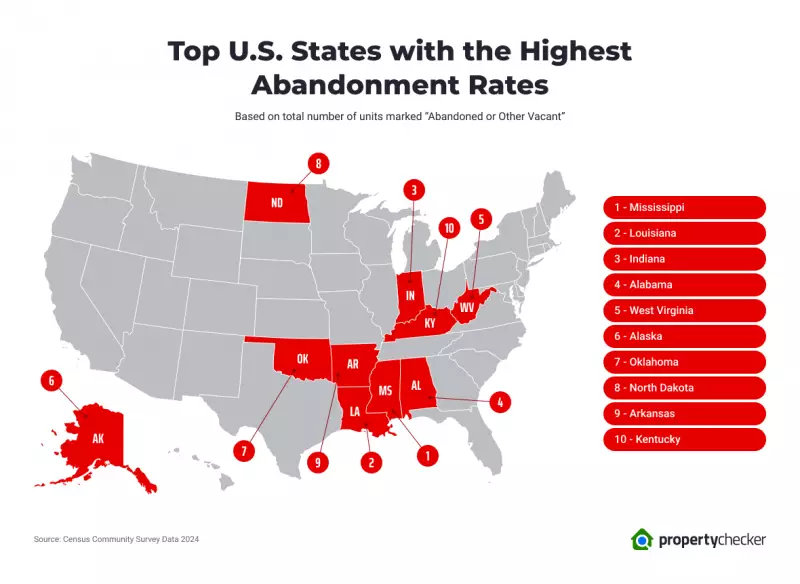

Mapping the Vacancy Landscape

While national averages suggest that roughly one in ten U.S. homes stands empty, the reality is far more uneven. Vacancy isn’t just a rural or seasonal issue—it clusters, and in some states, it signals deeper structural challenges.

According to 2024 data from the Census Community Survey, more than 6 million residential properties are now classified as “Abandoned or Other Vacant.” But these homes aren’t equally scattered across the country. Certain regions are carrying a disproportionate share of the burden.

At PropertyChecker.com, we estimate that these abandoned homes collectively represent over $150 billion in lost housing value - a stark reminder of how much untapped potential lies in neighborhoods across the country.

But these homes aren’t equally scattered. Certain regions are carrying a disproportionate share of the burden

At the city level, high-profile metros like New Orleans and Miami have long been cited for elevated vacancy rates, often due to their large stock of vacation properties. But state-level data adds a different layer: it reflects not just second homes, but also long-term disuse—properties caught in cycles of foreclosure, neglect, or simply left behind by outmigration.

By contrast, states with lower abandonment rates—such as Colorado, Utah, and California—tend to have stronger job growth, tighter housing supply, and higher property values. There, empty homes are more likely to be flipped, rented, or redeveloped.

This new vacancy map doesn’t just highlight where homes are sitting empty. It also tells us something about where housing systems are failing—and where policy interventions may be most urgently needed.

The extent of the vacant property problem becomes strikingly apparent when comparing the abandonment rates to the 2023 geographic data.

Most major cities in the US have an area that has suffered from the blight of empty properties. Entire neighborhoods can feel the consequences when a major employer closes down or moves production facilities away

Why do houses become abandoned?

There are multiple reasons why the U.S. currently has so many lost properties. These properties become abandoned due to various economic and natural factors, and they often remain so. Let’s explore all the causes in more detail.

Foreclosures

Economic downturns push homeowners into default, forcing banks to reclaim properties that often sit vacant for years. The 2008 financial crisis resulted in nearly 10 million homes lost between 2006 and 2014, many of which remained abandoned due to legal and financial complexities that made them difficult to resell or repurpose.

Urban Decline

Once-thriving industrial hubs like Detroit, Cleveland, and St. Louis have lost population, leaving homes abandoned. The collapse of industries like manufacturing led to mass job losses, causing large-scale migration out of these cities, and leaving entire neighborhoods desolate. Between 1950 and 2020, Detroit’s population fell from 1.8 million to just over 670,000, with thousands of homes left to decay.

Detroit had many abandoned homes, from small houses to big mansions. In 2014, Detroit Land Bank began auctioning off for very low prices, sometimes as little as $1,000. The average price was around $55,000, but often, this was 4 or 5 times less than what the previous owners had paid.

Government Policy Failures

Historical policies such as the Housing and Urban Development Act of 1968 led to high foreclosure rates due to flawed credit requirements, disproportionately affecting minority communities.

Federal housing policies created after the great depression ensured that people of color were left out of new suburban renewal projects. Ready and willing homeowners were instead pushed into large housing projects still going on today.

The GI Bill and Redlining are examples of government housing policies. Redlining, which is a discriminatory practice, denied financial services to neighborhoods with many minority residents, preventing them from getting good loans, insurance, and other financial services.

More recently, eliminating the Affirmatively Furthering Fair Housing (AFFH) rule has sparked debate about zoning and housing opportunities. This policy change has the potential to exacerbate segregation and limit affordable housing options, further marginalizing vulnerable communities. These policy shifts and historical practices have created a complex web of systemic issues that contribute to the ongoing problem of lost properties and their uneven distribution across communities.

Disasters & Climate Risks

Fires in Los Angeles, hurricanes in Florida, and floods in the Midwest have created thousands of abandoned homes with little government intervention to restore them. In California, prolonged droughts and wildfires have displaced entire communities, and many homes are left vacant due to costly rebuilding regulations and rising insurance premiums that have made homeownership unaffordable.

In Florida, hurricane damage often forces homeowners to relocate permanently, with some neighborhoods remaining uninhabitable for years due to slow federal and state recovery efforts.

Zoning & Development Restrictions

Many local governments enforce restrictive zoning laws that prevent multi-family housing development, exacerbating the housing shortage while abandoned single-family homes remain unused. In cities like San Francisco and New York, restrictive zoning ordinances have made it nearly impossible to convert abandoned buildings into affordable housing units.

A study by the Brookings Institution found that restrictive zoning regulations increase housing costs by an average of 20% in many metropolitan areas. These high costs make it difficult for people to afford housing, which can contribute to increased rates of homelessness and housing instability.

The lack of diverse housing options resulting from restrictive zoning can lead to segregation. When zoning laws prevent the construction of affordable housing in certain areas, it can limit access for low-income families and people of color. This can perpetuate existing patterns of segregation and inequality.

The Hidden Cost of Abandonment

They say it takes a village to raise a child, so what happens when that village, that street, or neighborhood starts losing its population? The community atomizes, with fewer people visiting local shops and businesses. Schools close and services suffer, making the area less attractive to regular folks.

The local county assessor’s office is where you will find the direct impact of abandoned and distressed homes. Lower tax revenues can make a big difference in how local services can be delivered. When a community is affected by high rates of foreclosure or abandonment, it has a direct link to property values, which initiates a downward spiral of tax take.

Neighborhoods with an above-average level of abandonment fall foul of the broken windows theory, where neglect spreads. Empty houses, poorly maintained are a magnet for crime, drug users, and other gang-related activity.

Crime & Safety

Abandoned homes become hotspots for drug use, gang activity, and vandalism. Alaska and Vermont are prime examples of this. Between 2012 and 2022, violent crime has increased by 56%. Homicide has risen by 166%, and rape increased by 76%. Other areas of crime in Vermont have decreased against the national average. However, the correlation between abandoned and derelict homes, which most experts agree these areas attract crime, cannot be denied.

Alaska has crime rates far above the national average. Violent crimes, which include rape, murder, aggravated assault, and robbery, have all increased. The murder rate in Alaska has increased by 67%, and the state’s rape increase is nearly double the national average.

A study done in Chicago found that 83 percent of abandoned buildings in a neighborhood showed evidence of use for various types of crime, including prostitution and drug dealing, but they also argue that abandoned buildings can be used as “staging areas or gathering areas” for crimes committed elsewhere.

Economic Decline

Property devaluation leads to lower tax revenues, reducing funding for schools, emergency services, and infrastructure. Cities like Baltimore and Chicago have witnessed entire blocks of abandoned properties dragging down surrounding property values, leading to municipal budget shortfalls and underfunded public services. Declining home values also discourage new buyers, trapping remaining homeowners in depreciating neighborhoods with few options for financial recovery.

Mental Health Toll

Blighted neighborhoods cause higher stress, depression, and reduced community engagement. Studies indicate that individuals living in areas with high property abandonment rates experience more frequent anxiety, sleep disturbances, and even higher risks of cardiovascular disease due to chronic stress.

The presence of boarded-up homes, overgrown lots, and neglected infrastructure creates a sense of hopelessness, further discouraging community revitalization efforts.

Housing Affordability Crisis

There’s a lot of commentary about a housing crisis in the USA and how demand is outstripping the supply of properties for sale or rent. Housing construction in the US has long been cyclical, but has, in recent years, also been on a downward trajectory.

Kansas City has suffered from underbuilding since the recession more than 15 years ago. In 2023 it was reported that there was an affordable rental shortage in the city of up to 64,000 homes.

The Greater Kansas City Regional Housing Hub is bidding for federal funds to help unlock development to open doors for more development in the area.

This Harvard study into housing trends in the US can’t come as a surprise to property professionals. The trend shows high-cost burdens for both renters and homeowners in popular cities, coupled with high rates of homelessness.

Why aren’t new homes taking up the baton?

In May 2023 741,000 new homes were sold across the USA. A year later, the figure had dropped to 619.000 in May 2024. The continued high interest rates were a contributing factor. However, the lower rate of building on available tract development land has also kept the number of new properties coming to market down.

The new administration has hinted that federal lands may be opened up for residential zoning and development. This will likely bring down land costs, but with planning and development lead-in times, the housing market could be waiting three to four years to see any major impact on costs and availability.

If you are looking for a deal on a newly built property, it’s probably not a good idea to wait around. The average price for a new single-family house was $417,400 in 2024.

Meanwhile, in more than 237 cities in the US, there are starter homes on the market for $1 Million.

The forecast indicates material prices will rise through 2025 too, which will put pressure on developers who still need to make a profit. Labor is also expected to become harder to source, and more costly too.

All this will mean that affordability when it comes to new homes, will take a halt.

What can be done?

Decatur in Iowa was struggling back in the 1980s with more than 150 empty homes rapidly falling into disrepair. A homesteading program was set up and was soon oversubscribed. Today many of the original takers are still in the houses they helped to rehabilitate decades ago.

In Kansas City, an active homesteader program is up and running and administered by Legal Aid of Western Missouri. Applicants are required to have access to funds to pay for legal costs, have construction qualifications, and be prepared to finance all repairs required within nine months.

Applicants can use the services of the legal aid team to acquire distressed properties. Once the property repairs have been completed there is an occupation requirement of two years before title can be granted under the scheme.

In Buffalo, NY, the Urban Homestead Program is currently offering vacant lots for $1 plus closing costs. Applicants must rehabilitate an existing property or build a new home.

In Salem, NJ, the city legislature declared the entire urban area in need of rehabilitation due to the chronic level of property vacancy. Abandoned and under-utilized buildings are currently being greenlit for urban homesteading.

The regeneration of distressed properties, taking foreclosures, or otherwise abandoned properties, and getting them back into the market, is a great creative response to the current squeeze in all sectors.

For some critics of the state of the housing market, the fact that it is referred to as a marketplace is where all the problems start and finish. Urban homesteading programs can balance the scales of that argument.

Where affordable housing is a necessity, urban homesteading provides hitherto unavailable buy-in to a community and should be considered as part of an overall strategy to raise an area up for all.

Make the most of that hidden housing resource

When you read reports that Kansas City needs another 64,000 homes to house its burgeoning population, but that there are fifteen million empty properties nationwide, you’d think the housing crisis could be solved in a snap.

Sure, a way can be found where there’s a will to get something done. Employ your local networking and negotiating skills. There are programs and support that can take these empty properties and breathe new life into every community.

At local County, City, State, and Federal levels there are ways to organize and develop strategies to ease the problems of underbuilding and property neglect that will help to unlock the potential of abandoned properties.

Search Property & Deed Records

Table of Contents

- How Many Homes Are Abandoned in the U.S., Why It Happens, and What It Causes

- Why do houses become abandoned?

- Foreclosures

- Urban Decline

- Government Policy Failures

- Disasters & Climate Risks

- Zoning & Development Restrictions

- The Hidden Cost of Abandonment

- Crime & Safety

- Economic Decline

- Mental Health Toll

- Housing Affordability Crisis

- Why aren’t new homes taking up the baton?

- What can be done?

- Make the most of that hidden housing resource