Is House Flipping the Problem or Solution to America’s Housing Market Crisis?

Table of Contents

- Is House Flipping the Problem or Solution to America’s Housing Market Crisis?

- Understanding the Multifaceted Housing Crisis

- House Flipping: The Ultimate Market Disruptor?

- Competition with Owner-Occupants

- The Real Impact on Prices

- Are Flippers Just Putting Lipstick on a Pig?

- Market Impact: Adding Inventory, Not Just Profits

- House flipping is not Gentrification

- The Ethics of Flipping

- Reputation is Everything

- Community Benefits of Flipping

- How Do You Flip a House?

- Be Careful with Your Budget

- Where’s best for house flipping?

- The Future of Flipping

- Sustainable Housing Trends

- Adapting to Market Shifts

- Final Thoughts

The American Dream of homeownership is on life support. The idea of having a place to call your own, putting down roots, and building generational wealth? Slipping further out of reach. And who’s getting the blame? House flippers. The big, bad investors buy rundown homes, fix them, and sell them for a profit.

But is flipping the problem, or could it be part of the solution? The answer, as with most things in real estate, depends on how it’s done.

Understanding the Multifaceted Housing Crisis

Homeownership is more expensive than ever. The average interest rate on a 30-year mortgage hovers at 7.01%, significantly increasing monthly payments. In just four years, the median sales price of a new home was $417,300, lower than the existing home sales median price of $426,900, according to the report released by the U.S. Census Bureau.

At the same time, homelessness has risen sharply. In 2023, over 653,000 people experienced homelessness—a 12% jump from the previous year. Rising home values don’t just affect buyers; they also drive up rental prices, further deepening economic inequality.

Despite an 11.7% increase in overall home listings year over year, many of these properties sit unsold for weeks or months. Why? They’re often outdated, overpriced, or in disrepair. Newly listed homes, on the other hand, have declined by 6.2%, meaning buyers have fewer quality options.

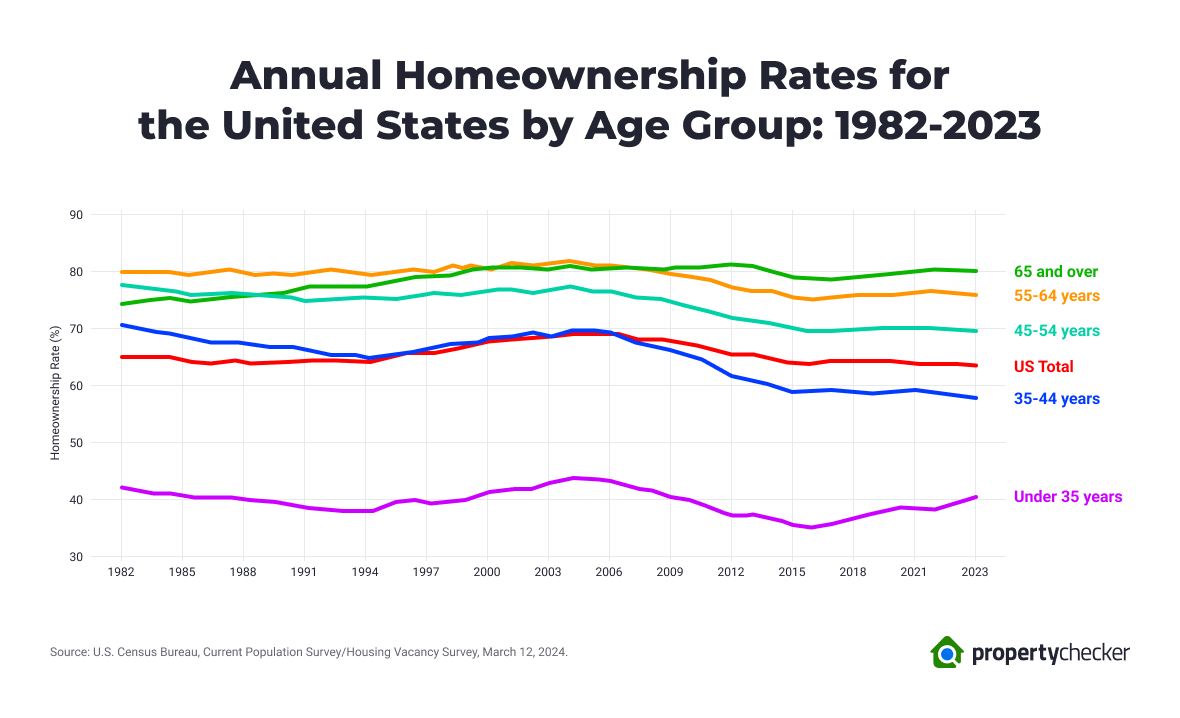

All of these numbers have affected the homeownership rate the most. For people aged 25–45 in the United States, it has declined from 45% in 1990 to 62.2% in 2024. This is due to several factors, including:

- Affordability: Housing affordability has been at a multidecade low.

- Mortgage interest rates: Mortgage interest rates are high.

- Housing supply: The housing supply is tight.

- Economic constraints: Economic constraints have limited young adults' ability to buy homes.

This is where house flipping can play a pivotal role. By transforming outdated or neglected homes into desirable properties, flippers bridge the gap between supply and demand, offering buyers more viable options at a time when affordability is already strained.

House Flipping: The Ultimate Market Disruptor?

House flipping is often painted in two extremes—either as a cutthroat money grab that skews housing prices or as a force for good, revitalizing neglected properties and giving communities a much-needed facelift. The reality? It’s somewhere in between. Flipping isn’t just about turning a quick profit; it’s about smart investing and, when done right, creating value for buyers and neighborhoods alike. I've seen houses flipping both ease shortages by restoring neglected homes and strain buyers by driving prices up. Its impact isn't one-sided; it depends on intent, execution, and local market needs." Dominic Leto, CEO of Sell My Home PA

But is the practice helping or hurting the market? Let’s break it down.

Competition with Owner-Occupants

A common critique of house flipping is that investors are snatching up homes that would otherwise go to families. In reality, the competition isn’t as direct as it seems.

Owner-occupants can often afford to pay more than a flipper. Flippers must factor in costs that regular buyers don’t—repairs, materials, labor, holding costs, and financing.

Additionally, many flipped homes wouldn’t even qualify for traditional FHA or VA loans due to their condition. “Houses that flippers buy—like those with holes in walls or broken plumbing—often don’t meet those standards, meaning we’re not competing for the same properties,” house flipping expert Mark Ferguson explains. Many of these properties would remain vacant or deteriorate further without investor intervention.

The Real Impact on Prices

Another myth is that house flippers drive up home prices artificially. Ferguson debunks this, stating, “Appraisers typically won’t value a house beyond what comparable homes in the neighborhood are selling for.”

There are natural limits, or neighborhood caps, on home values. Flippers aren’t in the business of overpricing—they need to buy at a discount, renovate efficiently, and sell at competitive rates to make a return.

Are Flippers Just Putting Lipstick on a Pig?

The perception of house-flipping as a quick-fix, cosmetic-only industry isn’t entirely unfounded—but it’s not the full picture, either. While some flippers focus on superficial updates, seasoned professionals like Sergio Aguinaga from Michigan Houses for Cash prioritize structural improvements.

“My team and I thoroughly inspect the homes we purchase, addressing major issues like plumbing, electrical, and structural repairs,” he emphasizes. Buyers should still do their due diligence.

“Inspections are crucial for homebuyers, especially with flipped homes,” Aguinaga warns. Not all flippers operate with integrity, but those who cut corners risk reputational damage and financial loss.

Market Impact: Adding Inventory, Not Just Profits

Flippers don’t just profit from housing—they help supply it. Aguinaga sees them as playing a vital role in the housing ecosystem by “adding inventory” and “revitalizing neighborhoods.” Instead of harming the market, flipping can help by bringing vacant, unlivable homes back onto the market, giving buyers more options in areas where housing is scarce.

House flipping is not Gentrification

One of the biggest criticisms of house flipping is gentrification. The worry is that flipping makes individual homes look better; it also drives up property values, pushing out long-time residents and changing the entire vibe of a neighborhood.

And it’s a fair concern. One flipped house won’t spark a full-blown transformation, but when multiple renovations happen in the same area, prices can start creeping up—and not everyone can keep up.

But there’s another side to the story. House flipper Steven Shelton makes an interesting distinction: “Large-scale developers are the real gentrification drivers, not individual flippers. Flippers help stabilize neighborhoods by fixing up existing homes without massively inflating their prices. That, in turn, makes these areas less appealing to big-time developers looking to swoop in and overhaul entire blocks. In this view, flipping isn’t the cause of displacement—it’s a defense against it.”

Studies done by the Urban Institute show the main reason for gentrification is high housing costs resulting from a lack of available housing. When housing supply is limited, affluent buyers look to low- and moderate-income (LMI) neighborhoods for housing, driving up demand and prices in those areas. They state, "That means cities' housing supply can determine how fast gentrification may occur. Boosting the supply of housing can slow the pace of new buyers moving into lower-income neighborhoods."

So, what’s the truth? As with most things in real estate, it’s not black and white. While most flippers don’t intend to price out locals, their work can still contribute to market shifts.

The key? Ethical flipping—fair pricing, honest renovations, and a real effort to respect and engage with the community. A good flipper knows there’s a fine line between improving a property and changing the soul of a neighborhood. The best ones make sure they don’t cross it.

The Ethics of Flipping

One common criticism of house-flipping is its potential to price out lower-income buyers, contributing to gentrification. However, Patrick Goswitz, CEO of Sell My House Fast, insists that flipping done right helps to address an actual need: “House flipping isn’t the solution to all housing problems, but it can solve specific issues for homeowners who need to sell a house quickly or can’t manage necessary repairs.”

Goswitz emphasizes ethical flipping, which involves fixing properties properly without cutting corners. Ethical flipping means you don’t hide problems under fresh paint or drywall. If there’s a foundation issue, an ethical flipper will invest in fixing it rather than covering it up.

Reputation is Everything

Whether you’re a small-scale flipper or a large corporation, your reputation in the community matters. When you’re flipping houses, it’s not just about making money. It’s about building relationships that help you thrive in the long term. Unlike large companies like Zillow, which may struggle with local relationships, the focus is on maintaining connections and delivering high-quality work.

Local knowledge, combined with a strong reputation, makes a huge difference in the flipping industry. It’s not just about selling homes; it’s about contributing to the community's overall health and revitalization.

Community Benefits of Flipping

The benefits of house flipping extend beyond just individual homes. Aguinaga reflects on his most impactful project, a house that had been condemned for years but was brought back to life. “It was a mess, but when we finished, the whole neighborhood felt the positive change. The community appreciated the effort, and we made a real difference.”

Flipping can help reverse neighborhood decline, as a single renovated home can act as a catalyst for wider community improvement.“When a neighborhood has neglected properties, it can drag down the whole area. But when flippers step in, it can create a ripple effect of renewal.”

House flipping accounts for a decent percentage of all homes sold every year, up to 8% in some states. It can provide a steady stream of work for contractors in trades from carpentry to plumbing, electricians, and decorators.

Realtors require a regular supply of properties to list, to keep their stock fresh. Oftentimes, they will have a wait list of folks who need to find a place in the right location.

Structural engineers, surveyors, and architects all benefit from the activity of house flippers. They help to make sure a flipper is building to the latest code recommendations and can make the difference between a flip failing or making a bank.

How Do You Flip a House?

It starts with identifying the right properties—typically abandoned or foreclosed homes that have been overlooked.

“When you're flipping a house, you need to find the least attractive property in the neighborhood, but one that has potential,” Aguinaga explains. Location is key, and knowing up-and-coming neighborhoods with good schools and amenities is crucial.

He emphasizes the importance of networking with realtors who might have properties before they hit the market. “Talk to the realtor; they often know of properties that haven’t been listed yet but are ripe for flipping. Building relationships in your local market is essential to success.”

Be Careful with Your Budget

While identifying a good property is essential, managing the budget is where many flippers falter. Aguinaga learned this the hard way. “My first flip went over budget because the contractors weren’t as reliable as I thought they would be”. His advice? “Stick to your budget and don’t overestimate your ability to handle a project. If it’s beyond your scope, walk away.”

Make sure to stick to the “70% Rule”—a financial guideline to determine the maximum price a flipper should pay for a property. The rule is simple: Take the expected After Repair Value (ARV) of the home and offer 70% of that price, allowing for renovation and sales costs. It’s a solid way to ensure you're not overextending financially

Where’s best for house flipping?

When choosing an area to flip houses, it's important to rely on a solid understanding of the local market. While some cities like Detroit and Boston are often highlighted as profitable for flipping, success depends more on neighborhood-level trends and growth patterns. Local factors—such as job market changes, interest rate fluctuations, and housing inventory—can significantly influence profitability, making on-the-ground knowledge essential for smart investment decisions.

Geographic Hotspots

Some states have outperformed others when it comes to return on investment for house flipping in 2024. According to recent data:

- Pennsylvania leads the nation with an impressive 80.2% ROI and an average gross profit of $112,250.

- Maryland follows closely with a 71.0% ROI and a $149,414 profit.

- Illinois, Louisiana, and Virginia round out the top five, all delivering ROIs above 59%.

States like New Jersey and Delaware also performed strongly, both in profit and percentage return.

Where to Avoid

Not all markets are created equal. Based on the latest ROI stats:

- Montana ranks the lowest, with a shocking 0.8% ROI and just $3,734 in average profit.

- Idaho, New Mexico, Texas, and Hawaii also posted notably low returns, with ROI percentages all under 10%.

These numbers reflect the importance of choosing your market wisely. Even traditionally hot real estate states like California and New York underperformed when ROI is considered, despite high gross profits.

While headline-grabbing cities may tempt new investors, the smartest flippers dig deeper. ROI varies dramatically by location, and what looks good on paper may falter without strong local knowledge, the right contractor network, and realistic budgeting. Use data as a guide—but let experience, research, and boots-on-the-ground insight lead your next move.

The Future of Flipping

Flipping isn’t going anywhere. As housing demand continues to outstrip supply, house flippers will play a role in filling the gap.

Sustainable Housing Trends

Flipping aligns with sustainability efforts. Rather than tearing down old structures and generating waste, flippers extend the lifespan of existing homes through smart renovations. The real estate industry’s push toward sustainability means more energy-efficient upgrades, recycled materials, and lower carbon footprints—all areas where house flippers can make an impact.

Adapting to Market Shifts

Rising interest rates and fluctuating inventory levels may change how flippers operate, but adaptable investors will thrive. Future trends point to:

- More hybrid properties (flips that double as short-term or rental investments).

- Niche renovations (creating home offices or multi-generational living spaces).

- Tech-driven flips (using AI and big data to identify high-potential properties).

Final Thoughts

House flipping isn’t a simple good-or-bad equation. When done ethically, it revitalizes neighborhoods, creates jobs, and adds to the housing supply. The best flippers understand that their success depends not just on making money but on making a difference.

As the market evolves, those who embrace smart, sustainable flipping practices will continue to shape the future of real estate—one house at a time.

Search Property & Deed Records

Table of Contents

- Is House Flipping the Problem or Solution to America’s Housing Market Crisis?

- Understanding the Multifaceted Housing Crisis

- House Flipping: The Ultimate Market Disruptor?

- Competition with Owner-Occupants

- The Real Impact on Prices

- Are Flippers Just Putting Lipstick on a Pig?

- Market Impact: Adding Inventory, Not Just Profits

- House flipping is not Gentrification

- The Ethics of Flipping

- Reputation is Everything

- Community Benefits of Flipping

- How Do You Flip a House?

- Be Careful with Your Budget

- Where’s best for house flipping?

- The Future of Flipping

- Sustainable Housing Trends

- Adapting to Market Shifts

- Final Thoughts