What Is Escrow and How Escrow Accounts Work for Homeowners

Table of Contents

- What Is Escrow and How Escrow Accounts Work for Homeowners

- What Is Escrow on a Mortgage?

- How Does an Escrow Account Work?

- What Does Escrow Cover?

- Why Escrow Matters

- Pros and Cons of Having an Escrow Account

- Can You Opt Out of Escrow?

- Escrow Shortages, Overages, and Annual Analysis

- Escrow in the Home Buying Process

Escrow refers to a financial arrangement where money is held by a third party to ensure certain property-related obligations are fulfilled. It is most commonly associated with mortgage loans, where an escrow account is set up by the lender to manage and pay property taxes and homeowners' insurance on behalf of the borrower.

Escrow plays an important role in both the home-buying process and ongoing homeownership. It helps ensure that critical payments are made on time, reduces risk for lenders, and offers budgeting support for homeowners. In this guide, you will learn how escrow accounts work, what they cover, how they are managed, and what to expect if you choose to opt out or experience a payment adjustment. Understanding escrow is essential for managing your mortgage responsibly and protecting your investment.

What Is Escrow on a Mortgage?

Escrow is a financial arrangement in which a third party holds money on behalf of two other parties until some specific conditions are fulfilled. In mortgage terms, an escrow account is a special account set up and managed by the lender or loan servicer. The escrow account is used to collect and hold funds from the homeowner to pay property-related expenses, such as homeowners' insurance and property taxes. Instead of the homeowner paying the bills directly, they make monthly contributions as part of their mortgage payment. The lender then uses the money in the escrow account to pay taxes and insurance premiums on time, ensuring that important financial obligations are met.

How Does an Escrow Account Work?

An escrow account works to help manage and pay certain property-related expenses on behalf of the homeowner. Each month, a borrower makes one combined mortgage payment that typically includes principal, interest, taxes, and insurance. The principal and interest go toward repaying the loan, while the taxes and insurance portions are placed into the escrow account. The loan servicer or lender holds these escrow funds and uses them to pay the property tax and insurance bills when they are due.

For instance, if a borrower pays $2,000 every month, that may include a $1,700 principal and interest, and $300 for property taxes and insurance. The $300 will be deposited into the escrow account. When the property tax bill or insurance premium is due, the lender uses the funds from the escrow account to make the payment directly to the appropriate agency or insurer.

What Does Escrow Cover?

Typically, an escrow account covers certain critical property-related expenses that must be paid regularly to protect the lender and the homeowner. Commonly, escrow covers the following:

- Property Taxes: Property taxes are local government taxes assessed on the value of the property. Funds collected through escrow ensure that the taxes are paid on time each year.

- Homeowners' Insurance: The homeowners' insurance protects the property against risks such as fire, theft, or natural disasters. The lender requires this coverage and uses the escrow account to pay the premiums as they become due.

Note that in certain cases, an escrow account may also cover mortgage insurance, such as in cases where the homeowner is required to carry private mortgage insurance, especially with a low down payment loan. Also, homeowners association (HOA) fees may be included in escrow if the property is part of an HOA and the lender agrees to manage these payments.

Why Escrow Matters

An escrow account plays an important role in a mortgage as it serves to protect the interests of the homeowner and the lender. By setting aside money every month for property taxes and insurance, escrow ensures that these critical bills are paid on time. Consequently, this prevents lapses in homeowners' insurance coverage and avoids penalties or liens from unpaid property taxes.

For borrowers, escrow makes it easier to manage large annual or semi-annual expenses. Rather than paying taxes or insurance in a single large lump sum, they contribute smaller monthly amounts, making budgeting simpler and easier. Also, for lenders, escrow reduces the financial risk of ensuring that the property remains insured and in good standing with local tax authorities.

Pros and Cons of Having an Escrow Account

Pros:

- Convenience: Homeowners make a single monthly payment that covers the loan and key property expenses.

- Budgeting Help: Escrow spreads out large costs into manageable monthly payments.

- No Missed Payments: The lender ensures taxes and insurance are paid on time, avoiding penalties or coverage gaps.

Cons:

- Less Control: Borrowers do not pay the bills themselves and cannot choose exact payment dates.

- Escrow Shortages or Overages: If tax or insurance costs change, the account may have too little or too much money, leading to adjustments.

- Changing Monthly Payments: Escrow re-evaluations may cause increases or decreases in the total monthly mortgage payment.

Can You Opt Out of Escrow?

You may be able to opt out of escrow in certain cases. For instance, a borrower may be allowed to opt out of having an escrow account if they meet specific conditions set by the lender, such as making a large down payment, typically 20% or more, or having a strong credit profile.

However, choosing to waive escrow often comes with added responsibilities. Without an escrow account, the homeowner must manage and pay property taxes and homeowners' insurance directly. This typically means keeping track of due dates, budgeting for large annual or semi-annual bills, and ensuring that payments are made on time to avoid penalties or coverage lapses. Hence, the risk of missed or late payments increases, which may lead to serious consequences such as tax liens or canceled insurance policies.

Escrow Shortages, Overages, and Annual Analysis

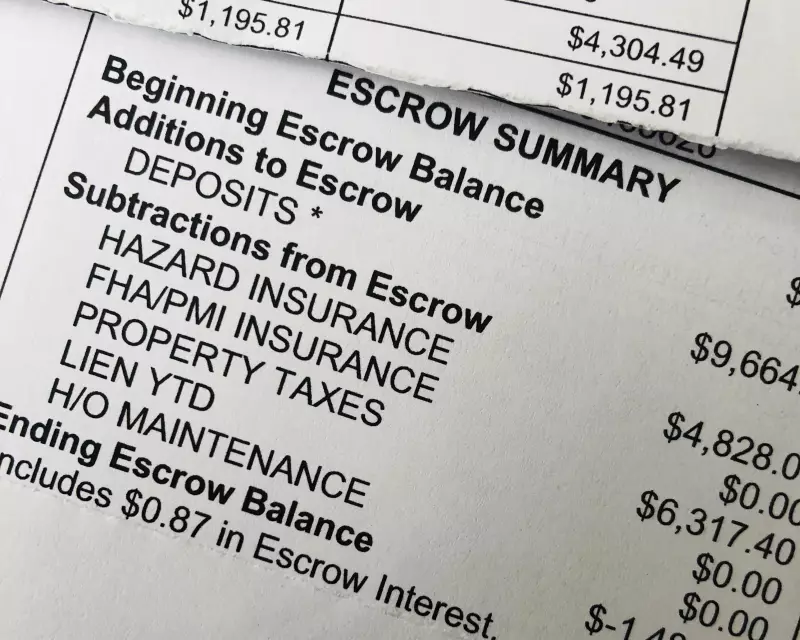

Each year, lenders perform an escrow analysis to review how much was collected and spent from a borrower's escrow account. This analysis helps ensure that there is enough money to cover property taxes and insurance, and to adjust future payments if needed.

An escrow shortage occurs when there is not enough money in the escrow account to pay the necessary bills. This may occur if taxes or insurance costs increase. On the other hand, an escrow overage happens when there is more money in the account when needed.

When a shortage or overage occurs, the lender sends the borrower a notice with details of the results of the escrow analysis. If there is a shortage, the borrower is often provided with options such as offers to pay the full amount at once or spread the payment over the next 12 months through slightly higher monthly payments.

Escrow in the Home Buying Process

Besides its use in the mortgage process, escrow may also play an important role in the home-buying process. During this process, escrow refers to a neutral third party, usually an escrow company or agent, that is tasked with holding funds and important documents until the transaction is completed.

For instance, the buyer usually deposits earnest money into escrow as a sign of good faith. This fund is held safely until the sale is finalized. Throughout the closing process for the transaction, the escrow agent will ensure that all conditions of the purchase agreement are met, such as inspections, title review, and financing. Once everything is complete, the escrow agent distributes the money and officially closes the sale.

Note that escrow during the home-buying process is temporary and helps manage the transfer of ownership, while a mortgage escrow account is long-term and helps manage future property expenses such as taxes and insurance after the home is purchased.

Search Property & Deed Records

Table of Contents

- What Is Escrow and How Escrow Accounts Work for Homeowners

- What Is Escrow on a Mortgage?

- How Does an Escrow Account Work?

- What Does Escrow Cover?

- Why Escrow Matters

- Pros and Cons of Having an Escrow Account

- Can You Opt Out of Escrow?

- Escrow Shortages, Overages, and Annual Analysis

- Escrow in the Home Buying Process